Decision Quality and Picking Stocks

What a poker player can teach us about decisions

I'm glad to be back after a few months of hiatus with my newborn and hope to be a lot more regular going forward.

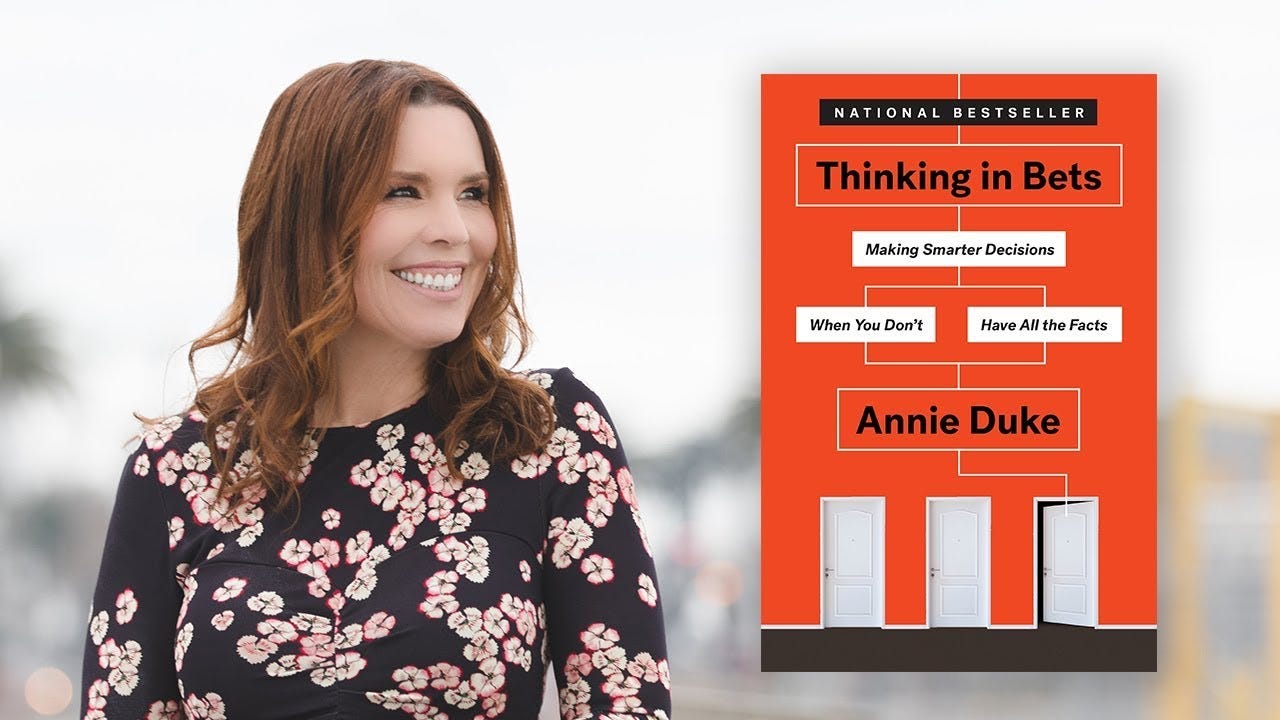

One of the books I've been recently reading is Thinking in Bets by Annie Duke - it’s a fantastic book about decision-making told from the point of view of a poker player (summary). A typical poker player has to take hundreds and thousands of decisions during the course of a game night, and interestingly enough, there's a huge amount of "luck" involved in successful outcomes - much like real life.

One of the biggest proponents of decision quality was Alfred P. Sloan, who famously observed that his main output was the "quality" of his decisions and not the output of labor as how others were measured during his time, and which made General Motors the bell-weather for over a century.

A few things really stood out for me. First, decision quality may not directly correlate with outcomes. A lot of success in life comes by way of luck - which many people in modern careers can attest to. One chance meeting with somebody could lead to funding (it happened to us!), or a great candidate you had no chance of closing or a lucky break with a customer that takes your trajectory to a whole new level. Annie calls this awareness (or lack thereof) “resulting” - and the need for studying decisions irrespective of outcomes.

That said, the quality of decisions is still very important. The main expectation should be to set ourselves up for the best possible outcomes that luck and serendipity can bring. How can we best position ourselves to capture upside from a chance encounter, or mitigate the risk of losing our biggest customer to a critical executive departure - all of which we have no control over.

Also, fascinating is the idea of a Ulysses Pact - a contract with ourselves which binds us to better quality decisions in the future when we may not have the right mindset for the decision. Ulysses had himself bound to the masthead and waxed his men’s ears so that he would not be swayed by the siren’s songs. Many times, we have to make sure that we make good decisions when shit hits the ceiling — and clear advance directives are important.

Another train of thought while reading the book was how management structures in modern enterprises have evolved to make decision-making more inclusive and diverse. We all believe that diversity in decision-making leads to better outcomes, yet we all celebrate the decision-making prowess of celebrities like Steve Jobs. They all drove to higher quality decisions without the overhang of the committee. Startups often make fun of terribly slow decision-making at some of the greatest companies of our time - and believe their speed is their biggest strength - I have often found myself confused about this conundrum.

One way I have been thinking about this in terms of bets, much like a stock portfolio. Each decision can lead to a certain number of outcomes. Early on, the founders (or a very small group) probably take all the decisions - much like how you need "concentrated portfolios" for wealth generation. The risk of ruinous decisions that come with it is what helps with higher returns: if you must chase alpha, you have to be comfortable with the beta. Startups and early-stage investors are well aware of the probabilities of survival, which could be just one bad decision away.

However, as a company grows, a lot of decisions need to be made more collaboratively - we come up with many constructs. For instance, the "builder" side of the house has many actors - Product, Engineering, Program Management, Strategy — often there's a lot of overlap in what each of them does and this is where I believe the whole idea of "matrix" management evolved from. It is my (possibly mistaken) belief that one of the main aims of these constructs is to keep decision-making out of the hands of "one" and have diverse opinions align to ensure the best decisions surface. This is much like a "diversified" portfolio, where you are probably going to beat the overall market by a bit, but not a lot. However, for a large enough portfolio with the aim of wealth preservation, this is a swell strategy. Similarly, once the company acquires enough scale and momentum, this is a much better way to avoid unnecessary risks of concentrated decision making.

I'm still scratching my head on what is the indexing equivalent of decision making - don't make any decisions and just let momentum carry the day? Would you survive the next decade?

Engineering

A CI/CD pipeline for Machine Learning - great guide by GetYourGuide

An interesting discourse on engineering productivity where the author argues that productivity should be measured by the number of times the team gets blocked on any action

A great discussion on developer tools, and why they haven’t seen as much success. There’s so much good stuff out there - I wish we got to see more of it!

Leadership

Senior engineers build consensus. A great article that I enjoyed reading - the value of creating a tribe and alignment is not limited only to managers, but ICs can create huge impact as well

You are more likely to be happy in your job, if your manager is technical (from HBR). Reminds me of Apple’s philosophy of having highly technical managers. I’m glad most of the valley prioritizes leadership being technical (in their fields)

Startups

Open-Core, Managed Services, etc. are all the buzzword, but here’s a great article on why its still very hard to build open source companies from somebody’s first-hand experience. Grass is always greener on the other side.

Before Substack was hot, somebody was already monetizing newsletter subscriptions at massive scale: Seeking Alpha’s story of a verticalized newsletter marketplace

Breakdown of the Coinbase S-1 by a good friend and mentor