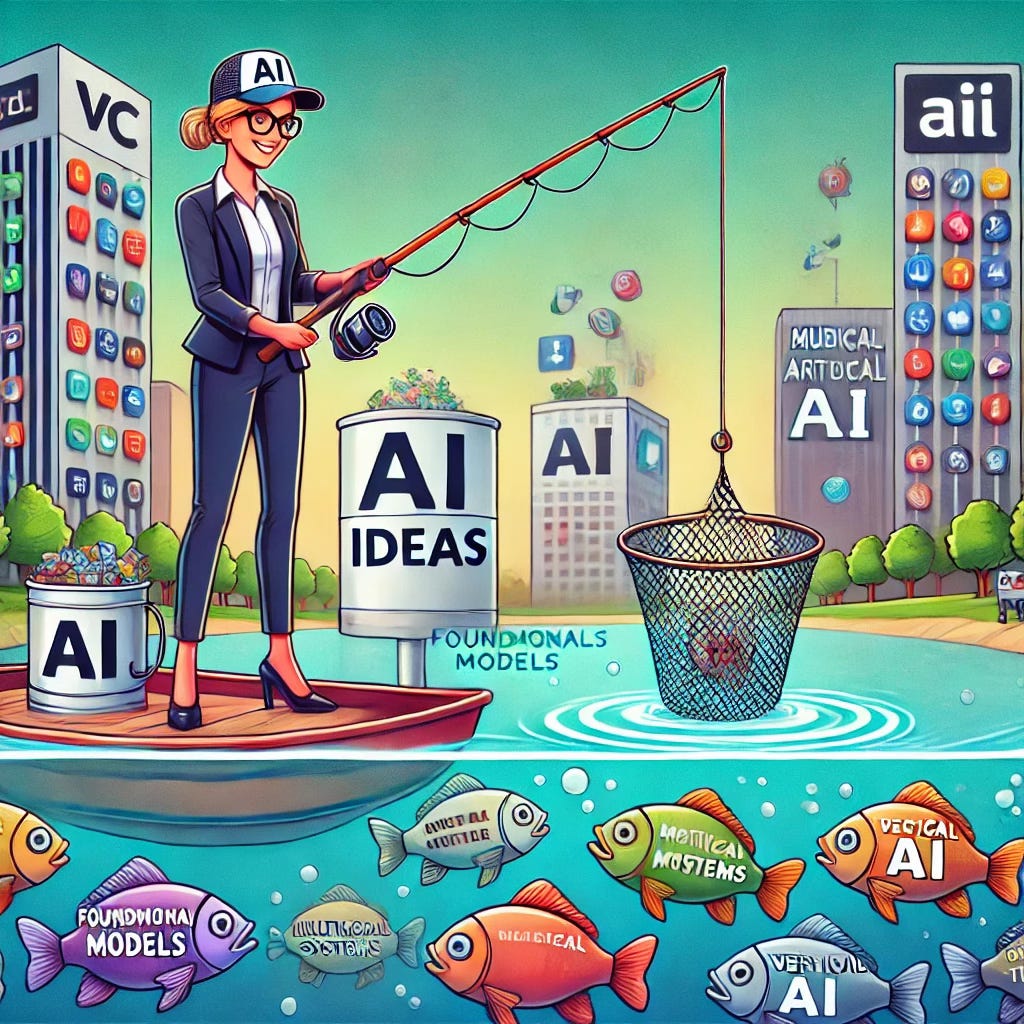

Fishing for AI Ideas: A Guide to the Modern (Artificial) Fishery

Where to build and invest in AI?

Welcome back, friends, dreamers, and Excel model warriors! After my last post on how quickly the AI landscape is evolving (think glaciers melting, only faster), I got a flood of messages asking, “Where should founders and investors fish for new ideas?” Grab your rod, and let’s cast a line into the AI pond—layer by layer.

1. Foundation and Infrastructure: Where Only the Big Fish Swim

Current Status: This layer’s flooded with big checks, big names, and big sharks. In the past year, investors threw money at foundation model infrastructure like people throw breadcrumbs at ducks. But here’s the thing: those “ducks” are now hungry giants—Meta, Microsoft, OpenAI, and Amazon. They’ve got balance sheets that could rival small countries, and they’re not playing fair. Trying to compete on infrastructure with them? Bring a supersized wallet (or a sovereign wealth fund).

Where’s the opportunity?

If you’re looking to make waves, color outside the lines:

• Real-time Systems: Think of high-speed data applications that can adapt instantly.

• Multimodal Models: Systems that go beyond text, integrating data from voice, video, and other inputs.

• Physical Systems: AI for robotics or hardware interfacing is still relatively open.

And don’t forget MLOps and Evaluation Systems—an area buzzing with open-source activity. If you have a way to improve how AI models are deployed, monitored, or measured, there’s still room to swim with the smaller fish - but the bar has become very high.

2. Applied AI - Horizontal Solutions: New Tricks in Old Nets

Alright, so you want to build horizontal AI solutions for mass adoption. Good call! This is also where a lot of the AI value will get created going forward. The picks and shovels businesses have to yield to the actual gold miners - for this to be a sustained disruption.

But there’s a catch: incumbents are doing the same thing. They’ve got the same memo, a trove of data to train on, and likely a million dollars more to throw at it. So how do you avoid just filling text boxes faster?

You’re also up against the ChatGPT Enterprises and the Gleans of the world, which CIOs are snapping up like hotcakes because, frankly, they need to be seen “doing something in AI.” (Nothing says “we’re on the cutting edge” like paying top dollar for something they still don’t know how to measure!) So, to stand out, your solution needs to be actually useful—like 10x better—and make sure you sell to the line of business buyer.

New Workflows to the Rescue!

The best way to stand out? Introduce entirely new workflows or tools that upend existing routines. Big companies might be great at churning out reports, but when it comes to risky workflow changes, they move at the speed of molasses. Startups have to think against the grain and change something that will give them the time and whitespace to build and grow. You can't make incremental improvements and expect to win - you have to be 10X better. That said there are a few places where startups can truly standout.

Risk Arbitrage

I was chatting with an exec at a multi-billion dollar company recently, and their AI team was drowning in risk assessments. With the scale they’re at, regulatory compliance is crucial. This is where startups can thrive—by creating nimble, testable ideas with capped regulatory risk.

New Modalities: Voice, Video, and Beyond

Forget text—AI that listens, watches, or (why not?) multitasks can change the game. Imagine Asana that joins your meetings, a Monday.com that delegates without the post-meeting headache, or a doctor’s office with AI that doesn’t miss follow-up questions. Modalities like voice and video open new frontiers for innovation and differentiation.

Rethink how value is delivered (or how you capture it!)

Back in the day, enterprise software pricing was pretty straightforward: charge by the number of processors—Oracle was happy to slap a $25-50K sticker on each one. Then came the cloud, and everyone switched to per-seat or consumption-based pricing. But will the future be pay-per-outcome? Imagine it: instead of counting seats or clicks, you charge based on actual results. That’d throw the old guard into a full-on existential crisis! Case in point—Intercom just launched its Fin AI agent on Zendesk and Salesforce, showing that if you can reimagine the business model, the big guys may not know what hit ‘em.

An AI for every employee

Ah, “AI Employees” are all the rage! But let’s not get carried away thinking they’ll replace your entire team just yet. A seasoned exec I spoke to recently mentioned they were getting pitched AI support left and right, but here’s the kicker: their level 1 support costs are already cut to the bone. What they actually want is help with the expensive stuff—think high-level customer service, not robo-answering FAQs.

This is where some good old-fashioned business building comes in: figure out what really matters to your customers, use AI where it counts, make it 10x better than the status quo, and show fast results.

3. Vertical AI: Catching Big Fish in Small Ponds

Vertical AI may not be new, but it’s still wildly profitable. Here’s the twist: AI doesn’t just improve processes—it bundles software with services, changing the value equation for customers.

Case in Point: Restaurants

Restaurants shell out 3-6% of revenue on software, but that’s peanuts compared to what they fork over for labor. Now imagine AI that handles inventory, takes orders, and does it all with the charm (and none of the sass) of a seasoned waiter. This AI waiter isn’t just jotting down orders—it’s assessing the situation. Customer looks unhappy? It knows whether to offer a dessert on the house or start the tiny violin orchestra. Food needs customization? It’s on it, creating a dish with all the flair and no extra charge for personality.

With the right AI, restaurants can do way more than set up a chatbot to handle “What are your hours?” questions. We’re talking real impact—making operations smoother, customers happier, and potentially shaving off labor costs. AI here doesn’t just boost productivity; it’s a new secret ingredient in the business model. Bon appétit!

Services as a Differentiator for Large ACVs

When it comes to high-value, deep-pocketed verticals, bundling software with services is like striking gold. It’s a huge opportunity to shake up the pricing model and make those gross margins look way healthier. Now, I know what you’re thinking: “Services? Aren’t those the low-margin, high-maintenance projects we’ve been avoiding?” But with AI leveling up our capabilities, those old hang-ups might just be outdated.

Look at Palantir—after a decade of everyone saying, “Wait, what exactly do they do?” they’re suddenly Wall Street’s comeback kid, with stock up 170% this year. Their magic recipe? A whole lot of software and services bundled into big-ticket contracts. AI might just mean we’ll see more of these once-misunderstood gems turning into overnight sensations (a decade later).

So, that’s where the fish are biting in the AI landscape. Founders and investors: grab your bait, pick your layers, and go after those untapped streams. And hey, if all else fails, remember, there’s always room in the AI-powered fishing market.