Letting it $SNOW... and a failed YC Founder opens up

Also, how similar are swimming and management?

Lessons from a failed YC SaaS Founder

This one hits close to home since Ankit Jain was somebody I had hired into Capillary back in the day. He subsequently had many other adventures and then started SprintAI, and found his way into the prestigious Y Combinator program. They shut down a few months ago - and Ankit did something remarkable - he chose to write about their mistakes and state their failures in trying to make India to US SaaS leap in a public blog post. I'm sure this took tremendous courage! Some areas that clearly stood out (and which I have learned from personal failures as well):

Try to get your product-market fit in your ultimate market. If your eventual goal is the US, getting to PMF in India/South East Asia is chasing fools gold.

The selling cultures, usage patterns, and customer expectations are vastly different and you need to ensure your team is focused on success and not chasing a mirage

Retail is a tough industry to sell to right now, more so in the US. The story, the ROI has to be super crisp

There's some real scarred tissue in this article, and this is a highly recommended read for anybody trying to build and scale a SaaS business.

Letting it $SNOW... Winter came early this year

What an incredible win for Snowflake! Everybody knows the story — with the halo effect of the Warren Buffet investment, to ultimately becoming a $70B public company. However, this story from Wing VC, one of their early investors, was a very interesting read because it talked about how different this bet was. Some things that stood out to me from the Snowflake journey:

Snowflake was incubated at Sutter Hill Ventures. Accel's $FB investment was worth $9B at IPO, Sutter Hill's $SNOW stake is worth $11Bn. You can bet a lot more VCs are discussing incubation in their upcoming Monday partnership meeting!

Snowflake founders don't really fit the Silicon Valley cool kids archetype, but I guess they did Ok :)

Relational databases where pronounced history — and NoSQL was all the rage (MongoDB, Cassandra, Redis, HBase). Of course, Snowflake has a huge community of analysts who speak SQL and this community is not going anywhere (also have you ever tried to write an aggregation query in NoSql?). Shows how technologies can change, but rebuilding communities takes a long time, and it’s so critical to focus on existing trained workforce. Snowflake happens to be much bigger than all of these no-SQL stalwarts several times over

Data Warehousing is bigger than we all thought. Who knew sharing data sets was going to be so big?

Clean pricing and infrastructure lock-in are still something a lot of companies care about (aka why AWS and GCP didn't kill Snowflake)

Whoever got IPO allocation (including Mr. Buffet) doubled their money on the first day of trading. See Bill Gurley's tweet-storm on the Snowflake pop. Given the current multiples, if AWS was a stock it would trade at $3-4Tn all by itself (all of Amazon is $1.5Tn).

Leadership Lessons from a Swimming Coach

10 Lessons from Bob Bowman, who was the coach of Michael Phelps, the Olympic champion. What caught my eye: (a) Beethoven was almost deaf when he conducted his 9th Symphony when he had gone deaf! (b) Frank-Lloyd Wright's story of the design of Falling Water is incredible - under 2 hours, after many weeks of turning things over in his head (c) Managing and coaching a swimming team is no different from managing high performing employees anywhere else :)

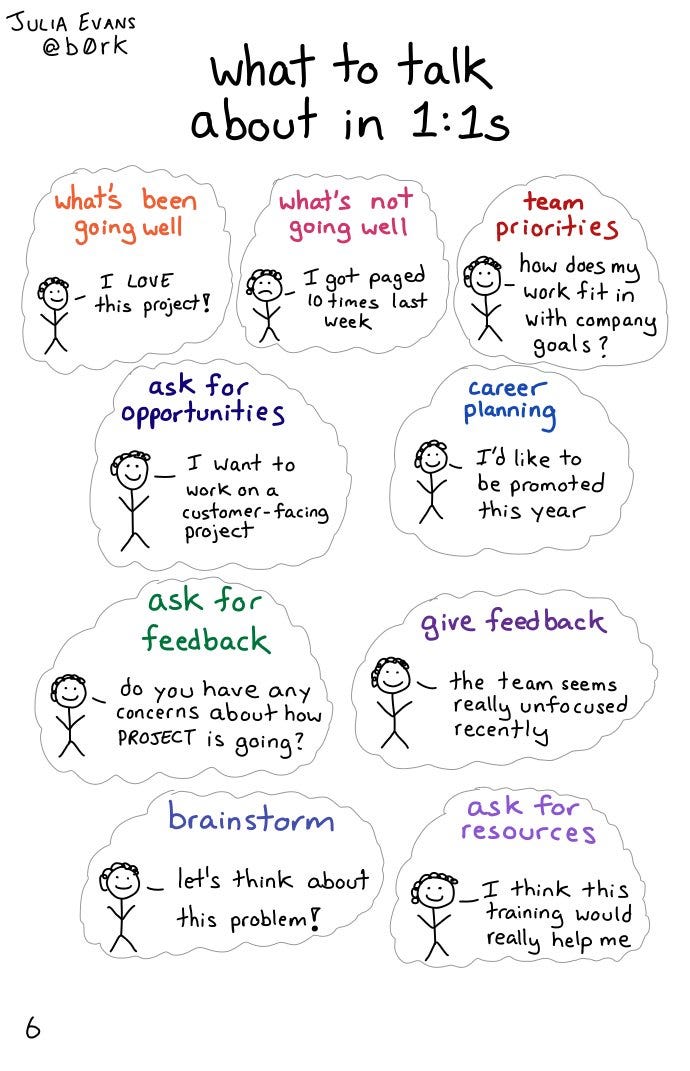

What to discuss in your 1-1s?

Simple things we always forget. Loved the beautiful graphic from @b0rk (and check out Wizard zines for more of her amazing collection)

Elsewhere

Jeff Wilke finally decided to hang up his boots and retire as CEO of Amazon Retail. While most of us know the other Jeff from Amazon, this thread really hit home and made me appreciate the value that Wilke brought to the table. From facing existential crises every year to building the largest distribution centers on the planet, his contributions to Amazon have been undeniable.

Softbank finally sold ARM to NVidia for $40B. If he had bought $32B worth of Vanguard 500 Index fund on 18-Jun-2016 (when he bought ARM), he would have made $50B. Softbank made 25% return on ARM, while NASDAQ was up 115% in the same time period. Also, he would have saved a bunch of money in management fees. Food for thought (True, that the calculation has a lot of gross approximations, but you get the gist)

Continuing on the theme from last weekend, Shekhar Gupta wrote about India's Triple Crisis. While the Chinese aggression and 'Act of God' Coronavirus is externally justified, there needs to be greater introspection about divisive politics. Chetan Bhagat (in one of his most cogent and readable essays), writes about the fact that there's no point arguing over what caused Covid (its a split bowl of milk) — we need to stop pointing fingers and focus on bringing the economy back.

You read about startups raising money from VCs, but how is it when VCs go to raise money from LPs? Read a teardown of a VC fundraising deck by an LP

Becoming an EIR at a VC Fund sounds pretty sexy, but it’s not always the best strategy — there are serious signaling implications and you might find having fewer parties to talk to. #throwback

Tiktok may find itself being saved by the most creative cloud infrastructure sales deal of all time (or maybe not.. we'll know on Sunday)