Big Cloud Earnings

Big Cloud declared their earnings this week. AWS landed at $11.60B, up 29% and Azure was at $6.3B based on analyst estimates (MSFT doesn't break out earnings for Azure - Intelligent Cloud was at $13B), and GCP brought in $3.44B, up 45%. Massive results all around and it’s incredible to see that Cloud continues to grow at a massive pace even at such a large scale. Reminds me of my post from earlier in the year and what differentiates the cloud providers. A week into Q3 earnings, other than Fastly, cloud and SaaS seems to be on a roll.

Discovering Product-Market Fit in Consumer vs SaaS

Great tweetstorm from Andy Johns about product-market fit for consumer startups - esp network effects businesses vs others. Per Andy, for network effects businesses, it’s best to optimize for growth loops and network expansion during the PMF whereas for other consumer businesses test the propensity to buy at the actual moment of truth.

It got me thinking - what does the same mean for B2B and SaaS companies. What should you optimize for early on? The purchasing cycle and channels are far more complex and PMF is not as easy to define. I would break down the achievement of product-market fit into having a clear framework and articulation for the following:

A clear measure of Value / RoI: By the end of this phase, you should have a clear articulation of what is the actual business value that the customer buys you for, either from a revenue expansion or cost reduction perspective (including things like productivity gains)

Distribution: By this time, you should be clear on your distribution, and how you intend to scale it. Are you trying to sell online in a freemium model, or do you need to build a salesforce - do you have green shoots that will grow into one? Is it bottoms up adoption or does it need to be sold top-down? What does your champion look like? What will be your ACV - will it justify field sales or do you need to stick to selling online, or through inside sales? How frictionless is your sales process?

Urgency: Strong PMF is often born out of strong urgency. What makes customers buy this right now? Why won't they buy from incumbents/alternatives? Sometimes, urgency could even be due to regulatory or non-financial reasons.

Most importantly, Logos: Enterprises buy what other enterprises have already approved. What logos have adopted your product? Will other logos look at these references and start thinking of you as a credible alternative?

Also Important — Lock-in: Do your customers start customizing your product (or their workflow) to fit their workflow so much so that it’s harder to displace. Is there some integration required after the initial wedge so that customers will feel locked into it? What product roadmap and engineering story will your customers continue to buy and stay locked into for in the next 18-24 months?

Unlike in consumer companies, for a B2B company, product-market fit is often loosey-goosey and not a binary state. Several of the above may exist but still not indicate a good PMF. For instance: A lot of times, startups get early logo wins due to their prior relationships, but that may not indicate PMF and a "pull" from the market. At other times, some products will start at the lower end of the market (small ACV) but quickly graduate into the enterprise after the first few logos, indicating very strong PMF (think of UiPath and RPA).

The other challenge is also that a lot of startups book services revenues/logos and use that to show logos/PMF. Some manage to climb out of this into a true product story, but many continue to wallow in services for eternity. Even if you achieve PMF, if you don't achieve it in the right sales channel, or even the right “geography”, it’s not interesting.

You need to keep questioning yourself about PMF to make sure that you are not chasing a mirage. Many companies will do mini-pivots in several of these areas as they get to $1-5M in ARR but hopefully, after that, the actual revenue and growth rate (TTDDD) is a clear indication of PMF. Until then, people are just guessing.

Organizational Design

I enjoyed reading this Anatomy of a Startup Organization. Gives a very crisp definition of the key OKRs for each department. Something that even experienced founders flounder with at times!

The value of documentation and async communications in a growing company can not be undermined but it’s often overlooked until it starts becoming a real pain. Some great tips on async communication but would have loved to see more examples of how an organization was able to change its sync culture to async. These things get ingrained in the culture and are really hard to change.

With the caveat that whatever works for Apple is probably not applicable to 99% of businesses out there, this HBR article is really well written. Functional vs BU is an old debate in management theory, but the story about the Portrait mode development really made it come alive.

Startups

Enjoyed this essay by Mike Vernal @ Sequoia on Market Size and how it’s almost spread on a 1/x graph! Another major factor though is also what percentage of the market a company is able to capture - the story for Zoom and Facebook is very different from Yelp as a result.

We have to prepare for a world where every company is a card company. A decade ago we started seeing the bundling of cards - by carrying Apple Pay or Google Pay you didn't need to carry your heavy wallet full of loyalty and payment cards with you, but the pendulum has swung to the other end. Now every tech company is launching a payments card since it’s an easy way to buy loyalty and skim off some fees while you do that. Also fascinating to see all the growth in B2B cards (Brex, Stripe, Shopify, Happay, etc.) - completely different use case about monetizing through financial products through early access to cash

Bootstrapping is never easy - the founder of Outseta relayed his story well including many of the hard truths that founders have to grapple with.

Follow-up article on Sutter Hill's playbook with Snowflake and Sumo Logic - two recent IPOs. If you have felt an overdose of Sutter Hill articles on this newsletter, I promise to stop posting more!

Engineering and Products

Serverless got off to a great start, but the reality has not kept pace with the hype. Ultimately the fundamental questions around vendor lock-in, cold-start problems, and limited ecosystem come back and haunt it and this article does a great job of explaining the challenges well.

Great to see Facebook pushing HTTP3/QIUC - will be interesting to see how we see adoption in the rest of the web verse.

ARM is gaining more popularity, but is it going to come with the collateral damage of more testing across platforms after the x86-led "peace" for so many decades?

A lot of these articles feel like content marketing to me, but I found the idea of harvesting customer trust into a growth loop very intriguing. Conventional "funnel" thinking doesn't cut it anymore.

This is so cool: somebody actually reverse-engineered McDonald's API so you can check if their ice cream machine is broken!

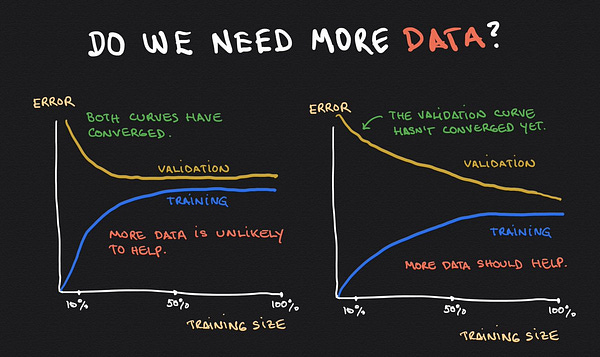

Great set of graphics that explain the various biases/limitations in machine learning

Great article. It's worth noting that velocity is an internal engineering team metric, different across companies (and even teams within companies), and not a useful external measure at all. As soon as it's used for that, it stops being useful for what it's really for, which is teams self-optimising better.